Introduction to Iron Condors

Are you an options trader aiming to diversify your trading strategies? Have you heard of the Iron Condor strategy but don’t know where to start? You’re in luck! This guide will provide you with all the essential information about utilizing Iron Condors to profit from range-bound or neutral market conditions. We’ll cover the fundamentals of Iron Condors, including how to initiate and adjust the trade, as well as strategies for risk management. Whether you’re new to Iron Condors or looking to sharpen your skills, this guide has something valuable for you. Let’s begin your journey to mastering the Iron Condor strategy!

Table of Contents

I. Introduction to Iron Condors

- Definition of Iron Condors

- When to use Iron Condors as a Trading Strategy

- Pros and Cons of Iron Condors

II. Setting up an Iron Condor Trade

- Choosing The Right Underlying Asset

- Identifying The Right Expiration Date

- Selecting The Strike Prices For The Call and Put Options

- Calculating The Maximum Profit, Maximum Loss, and Breakeven Points

III. Adjusting and Managing an Iron Condor Trade

- How to Adjust an Iron Condor Trade to Optimize Profits or Minimize Losses

- Common Adjustments for Iron Condors

- Managing Risk With Iron Condors

IV. Conclusion and Final Thoughts

- Recap of The Key Points Covered and Summary

Definition of Iron Condors

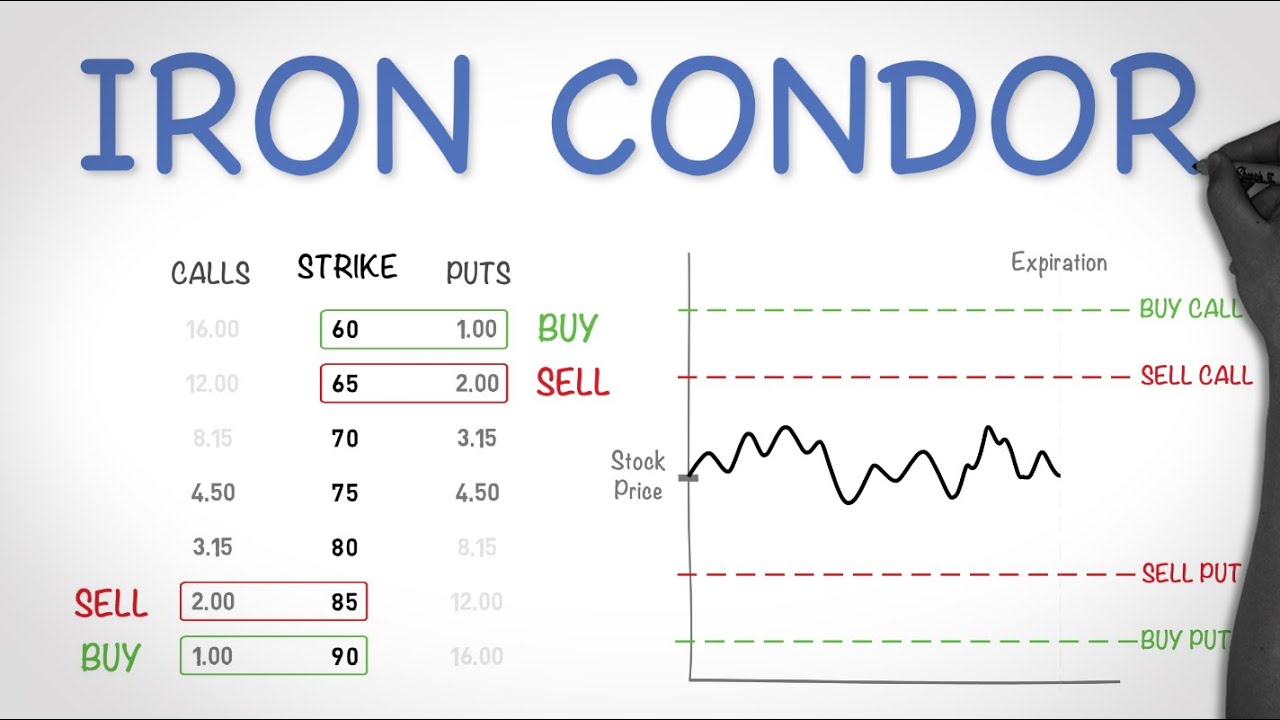

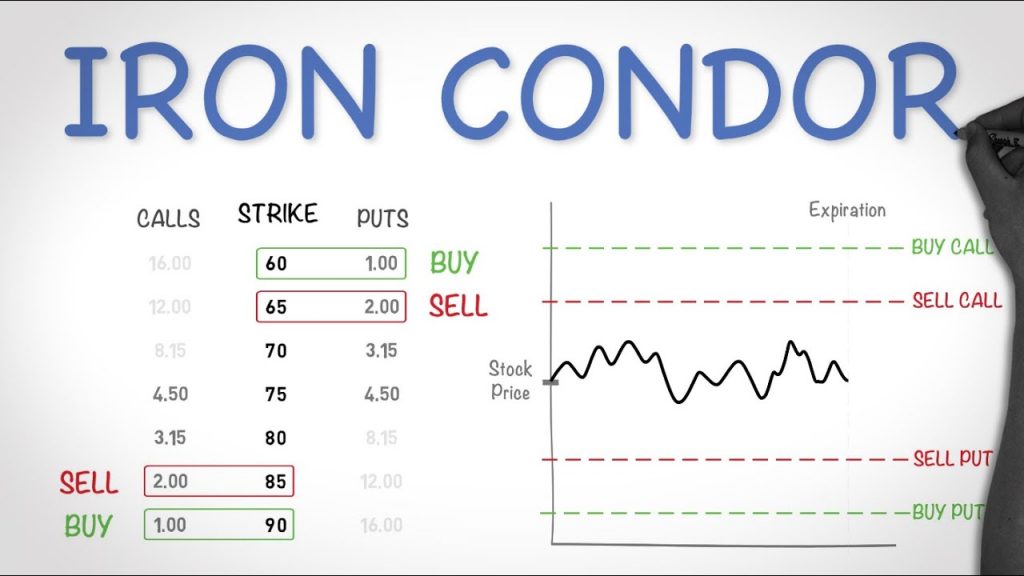

An Iron Condor is a neutral options trading strategy that involves selling both a call option and a put option with different strike prices while simultaneously buying a call option and a put option with different strike prices. The call and put options sold are further from the current price of the underlying asset, while the options bought are closer to the current price. The objective is to profit from the difference between the premiums received for selling the options and the premiums paid for buying the options, as long as the underlying asset stays within a specified price range. Essentially, this involves selling an Iron Condor for a credit, letting it depreciate from theta decay, and repurchasing it at a lower price.

When to Use Iron Condors as a Trading Strategy

Iron Condors are effective when you anticipate the underlying asset will remain within a specific price range and you want to profit from time decay. It is a neutral strategy, meaning you’re not betting on market direction.

Iron Condors are typically employed in range-bound or low-volatility markets, as these conditions favor the strategy. They are also well-suited for intermediate traders who understand options and how they perform under various market conditions.

Ideal market conditions for Iron Condors include:

- Range-bound markets: If the underlying asset has been trading within a narrow price range for some time, an Iron Condor may be beneficial.

- Low volatility: If the underlying asset has low volatility and is not expected to make significant price moves, an Iron Condor can profit from the options’ time decay.

- Neutral market outlook: If you don’t have a strong opinion on market direction, an Iron Condor can generate income without a directional bias.

Setting Up The Trade

Choosing the Right Underlying Asset

Selecting the right underlying asset is crucial when setting up an Iron Condor trade. Traders should opt for instruments they are familiar with, as each has its unique characteristics. Understanding the behavior of the underlying asset in relation to the overall market can help make an informed decision.

Consider these factors when choosing an underlying asset:

- Liquidity: Choose a highly liquid asset to facilitate easier entry and exit from trades, ensuring a narrower bid-ask spread.

- Volatility: Pick an asset with moderate volatility. Extremely volatile assets have high options premiums, which can reduce profits, whereas assets with very low volatility might not offer sufficient premiums.

- Earnings announcements: Avoid assets with impending earnings announcements that could cause notable price movements.

- Technical analysis: Use technical analysis to identify assets with clear trends, support, and resistance levels, and consistent historical price patterns.

- Relative strength: Assess the correlation between the asset and other market indices. Highly correlated assets may be more susceptible to market-wide movements.

Identifying The Right Expiration Date

Choosing the right expiration date is essential for a profitable Iron Condor trade. If the expiration date is too far out, the underlying asset may move against you. Conversely, if it’s too short, there may not be enough time for theta decay to work in your favor.

Consider the following when identifying the right expiration date:

- Time decay: Options lose value as they approach expiration. Choose an expiration date that balances enough time for the options to become profitable while capitalizing on time decay.

- Volatility: Higher volatility increases the likelihood of significant price movements, which can impact the trade. Select an expiration date suited to the asset’s volatility.

- Market conditions: Current market conditions and their potential impact on the asset should influence your expiration date choice. For instance, in times of economic uncertainty, opt for shorter expiration dates.

- Risk tolerance: Your risk tolerance will affect your choice. Higher risk tolerance may lead to longer expiration dates, while lower risk tolerance may result in shorter ones.

- Trading style: Your trading style should align with the expiration date. Swing traders might prefer longer dates, while day traders might choose shorter ones.

Selecting The Strike Prices For The Call and Put Options

When selecting the strike prices for the call and put options, aim for a balance. The strike prices should be far enough from the current price to be affordable, yet close enough to retain time value.

Steps to select strike prices:

- Determine the price range: Examine the asset’s price chart to identify its trading range over time.

- Choose the middle strike price: This is the strike price of the options you’ll buy, typically at the midpoint of the asset’s price range.

- Select the outer strike prices: These are the strike prices of the options you’ll sell, usually at the edges of the asset’s price range.

- Consider premiums: Ensure the options premiums are reasonable to keep the trade viable.

- Adjust for volatility and time decay: Modify strike prices based on the asset’s volatility and remaining time until expiration.

- Verify profit, loss, and breakeven points: Calculate these to ensure the trade’s profitability.

Calculating The Maximum Profit, Maximum Loss, and Breakeven Points

You’ll need the following details to calculate these:

- The asset’s current price

- Strike prices of sold and bought options

- Premiums received and paid

Formulas:

- Maximum profit = Net premium received – commissions paid

- Maximum loss = Difference between short call and short put strike prices – net premium received + commissions paid

- Breakeven point (lower) = Short put strike price – net premium received + commissions paid

- Breakeven point (upper) = Short call strike price + net premium received – commissions paid

By carefully selecting the right underlying asset, expiration date, and strike prices, and by accurately calculating potential profits and losses, you can set up a successful Iron Condor trade.

Conclusion and Final Thoughts

Iron Condors offer a robust way to capitalize on range-bound markets and time decay. By diligently choosing your assets, expiration dates, and strike prices, and by managing risks effectively, you can make the most of this strategy.